Future of Digital Banking experience through Trealit Philanthropy's Innovation

The home of the "Donate without spending"

Thanks to our unique philanthropy donation feature, customers are credited between 1% and 5% of their Overall purchases and these money are donated on the customers behalf to the iLaVita nonprofit Foundation. Customer will be able to claim these charitable contributions and get the Tax deductions.

Trealit Digital “Better than Banking” experience

Trealit’s “Better than Banking” solution:

By banking through us, you become a catalyst for change. We empower you to make a positive impact through your financial transactions while enjoying tax deductions.

Finally, an everyday banking experience that prioritizes people over profits.

Trealit - Social Impact made effortless

Join us today and be a part of this incredible journey!

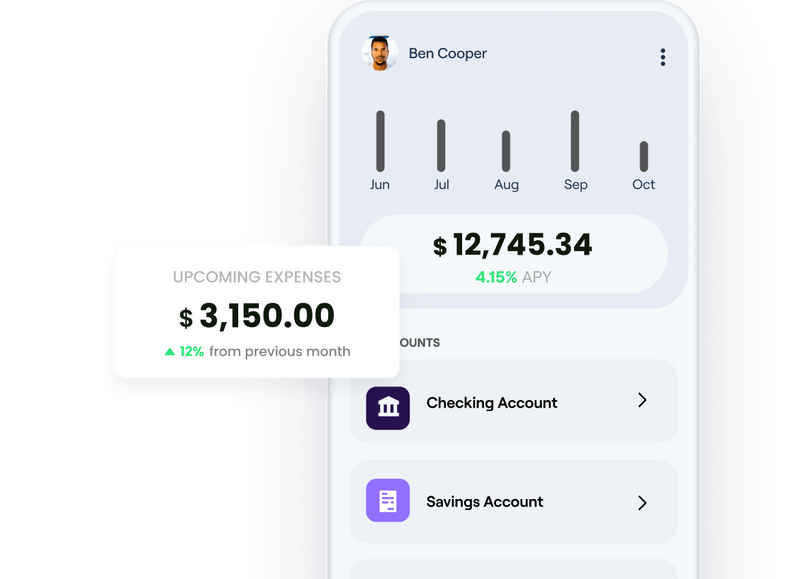

State of the Art “Better than Banking” App

Credit, Debit and Charge Cards

Full Service Banking Features:

Donate without spending

Thanks to our unique philanthropy donation feature, customers are credited between 1% and 5% of their Overall purchases and these money are donated on the customers behalf to the iLaVita nonprofit Foundation. Customer will be able to claim these charitable contributions and get the Tax deductions.

Trealit offers the following deposit accounts:

Individual Accounts

Interest-earning FDIC insured deposit accounts for individuals and sole proprietors with features that support cards, money movement, bill pay, cash advances, ATMs, and more. Accounts can be used for different purposes including checking, savings, or tax.

Business Accounts

Interest-earning FDIC insured deposit accounts for businesses with features that support cards, money movement, bill pay, cash advances, ATMs, and more. Accounts can be used for different purposes including checking, savings, or tax.

Joint Accounts

Interest-earning FDIC insured deposit accounts controlled by multiple individuals with features that support cards, money movement, bill pay, cash advances, ATMs, and more. Accounts can be used for different purposes including checking, savings, or tax.

Account Features:

Unlimited Accounts

Our customers can have as many accounts as they need. Each account receives a unique account number and can be managed separately.

Interest

Our customers can receive interest on their account balance. There are different interest options available to suite each and every customer, including the ability to offer more interest than the average bank provides.

Tax Advantaged Spending

We can offer to optimize our customers income by allowing them to spend on certain items tax-free. Trealit allows for HSA, FSA, and HRA debit cards to be issued to customers accounts.

Tax Management

Our customers can create dedicated account used for tax management that can help independent workers and freelancers automate their taxes.

Statements

We provide monthly statements to our customers with ease. Our statements are offered PDF format as well as English and Spanish.

Bank Verification Letter

We create better experience by providing customers with a letter confirming their account creation and details.

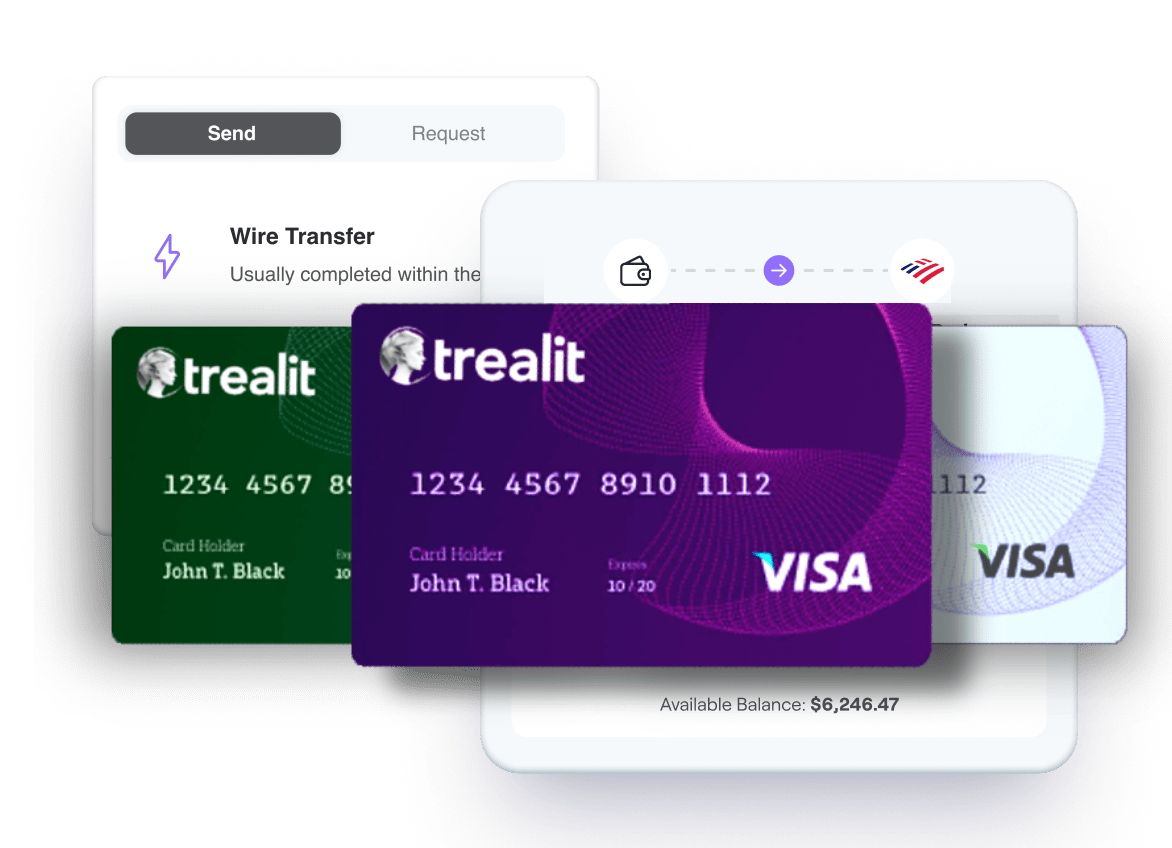

Cards: Debit, Charge, Credit

Physical Cards

We Issue physical cards with on-demand or custom designs created and shipped directly to our customers.

Virtual Cards

We issue virtual cards instantly, which are unique cards available to use immediately upon opening an account.

Add To Mobile Wallet

More convenience and card usability by adding cards to Apple Wallet, Google Wallet, and Samsung Pay.

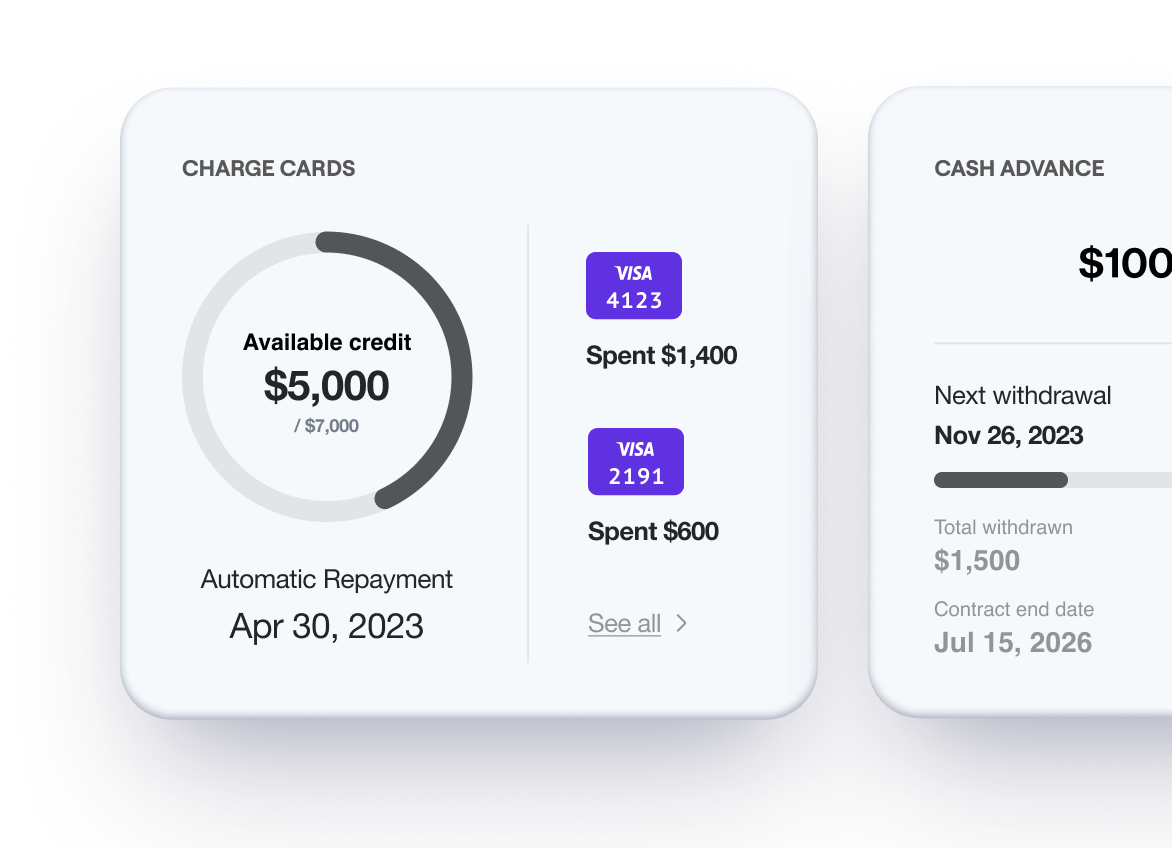

Charge Cards

We provide charge cards for the business and sole proprietor customers. Charge cards are cards with a credit limit that must be repaid in full every month. They are issued by Visa and can be used anywhere Visa is accepted worldwide.

Debit Cards

We provide debit cards for business, individual, or joint account customers. Debit cards are issued by Visa and can be used anywhere Visa is accepted worldwide.

Donate without spending

Thanks to our unique donation feature, customers will be credited between 1% and 5% of their Overall purchases and these money are donated on the customers behalf to iLaVita nonprofit Foundation. Customer will be able to claim these charitable contributions and get the Tax deductions. Wow – Donating without spending an extra dime!!!

Card Controls

Customers can fully manage their cards from within the app: freeze and unfreeze cards, report cards as stolen, and set and change the PIN on their debit cards.

Send and Receive money Locally and Internationally all within the App

Transfers between accounts

Instantly transfer for FREE between your own accounts, or to accounts of any Trealit holder.

Wires within the US

Create and manage your wires through the app without a trip to the bank. Rates are deeply discounted (between $5 and $10).

International Wires

Create and manage your international wires through the app, also without a trip to the bank. Rates are deeply discounted (between $10 and $15).

Full Service Banking App Features:

Donate without spending

Thanks to our unique philanthropy donation feature, customers are credited between 1% and 5% of their Overall purchases and these money are donated on the customers behalf to the iLaVita nonprofit Foundation. Customer will be able to claim these charitable contributions and get the Tax deductions.

Cards: Debit, Charge, Credit

Physical Cards

We Issue physical cards with on-demand or custom designs created and shipped directly to our customers.

Virtual Cards

We issue virtual cards instantly, which are unique cards available to use immediately upon opening an account.

Add To Mobile Wallet

More convenience and card usability by adding cards to Apple Wallet, Google Wallet, and Samsung Pay.

Charge Cards

We provide charge cards for the business and sole proprietor customers. Charge cards are cards with a credit limit that must be repaid in full every month. They are issued by Visa and can be used anywhere Visa is accepted worldwide.

Debit Cards

We provide debit cards for business, individual, or joint account customers. Debit cards are issued by Visa and can be used anywhere Visa is accepted worldwide.

Donate without spending

Thanks to our unique donation feature, customers will be credited between 1% and 5% of their Overall purchases and these money are donated on the customers behalf to iLaVita nonprofit Foundation. Customer will be able to claim these charitable contributions and get the Tax deductions. Wow – Donating without spending an extra dime!!!

Card Controls

Customers can fully manage their cards from within the app: freeze and unfreeze cards, report cards as stolen, and set and change the PIN on their debit cards.

Send and Receive money Locally and Internationally all within the App

Transfers between accounts

Instantly transfer for FREE between your own accounts, or to accounts of any Trealit holder.

Wires within the US

Create and manage your wires through the app without a trip to the bank. Rates are deeply discounted (between $5 and $10).

International Wires

Create and manage your international wires through the app, also without a trip to the bank. Rates are deeply discounted (between $10 and $15).

Trealit offers the following deposit accounts:

Individual Accounts

Interest-earning FDIC insured deposit accounts for individuals and sole proprietors with features that support cards, money movement, bill pay, cash advances, ATMs, and more. Accounts can be used for different purposes including checking, savings, or tax.

Business Accounts

Interest-earning FDIC insured deposit accounts for businesses with features that support cards, money movement, bill pay, cash advances, ATMs, and more. Accounts can be used for different purposes including checking, savings, or tax.

Joint Accounts

Interest-earning FDIC insured deposit accounts controlled by multiple individuals with features that support cards, money movement, bill pay, cash advances, ATMs, and more. Accounts can be used for different purposes including checking, savings, or tax.

Account Features:

Unlimited Accounts

Our customers can have as many accounts as they need. Each account receives a unique account number and can be managed separately.

Interest

Our customers can receive interest on their account balance. There are different interest options available to suite each and every customer, including the ability to offer more interest than the average bank provides.

Tax Advantaged Spending

We can offer to optimize our customers income by allowing them to spend on certain items tax-free. Trealit allows for HSA, FSA, and HRA debit cards to be issued to customers accounts.

Tax Management

Our customers can create dedicated account used for tax management that can help independent workers and freelancers automate their taxes.

Statements

We provide monthly statements to our customers with ease. Our statements are offered in PDF format as well as English and Spanish.

Bank Verification Letter

We create better experience by providing customers with a letter confirming their account creation and details.

✦ Trealit Banking Platform -Empowering Financial Reality through Technology and Philanthropy

In the rapidly evolving world of fintech, Trealit stands as a prominent player, providing users with a unique and impactful financial experience. As part of the Treality group of companies, Trealit leverages cutting-edge technologies and top fintech solutions, to offer a seamless and secure platform. With the added benefit of being backed by FDIC-insured US banks, Trealit ensures the safety and protection of users' funds.

Explore the name "Trealit" and its significance, as well as the app's key features, such as its social media block, philanthropic efforts, and innovative approach to supporting nonprofits through everyday banking.

1. The Name:

The name "Trealit" is derived from "Treality," representing the parent company, and "reality." Treality reflects the organization's vision of the unique banking platform empowering financial reality through technology and Philanthropy by offering practical, effective, and innovative solutions. By incorporating "reality" into its name, Trealit emphasizes a focus on tangible and user-centric financial services.

"Reality" signifies Trealit's focus on bridging the gap between the digital and real-world aspects of banking. It suggests that the platform aims to integrate customers' financial activities seamlessly into their everyday lives. Trealit's innovation for its clients includes the social features: "You Bank & Save, We Donate, You Get Tax Deductions." When clients use Trealit for their banking needs, the company donates a large portion (75%) of its profits to charitable causes on their behalf. Clients can benefit from tax deductions based on these charitable donations, providing them with financial advantages.

2. Philanthropic Initiatives:

One of the standout aspects of Trealit's business model is its commitment to philanthropy. A significant portion of Trealit's profits, specifically 75%, is donated to the iLaVita nonprofit Foundation. This generous contribution supports iLaVita's mission and allows the foundation to make a tangible difference in various areas of social impact, such as women security, innovations, and environmental sustainability.

3. Technology and AI Integration:

Trealit integrates AI algorithms to analyze user behavior, preferences, and financial patterns. This enables the app to provide personalized recommendations, insights, and guidance, empowering users to make informed financial decisions and optimize their financial well-being.

4. Social Media Block and Increased Engagement:

Trealit takes a unique approach to enhance user engagement through its social media block. Trealit creates connections and suggestions within the app, encouraging users to engage with each other and foster a vibrant community. This feature allows users to share insights, tips, and experiences, creating a supportive environment and increasing overall engagement on the platform.

5. FDIC Insured US Banks:

Trealit's partnership with FDIC-insured US banks is a significant factor that enhances the app's credibility and trustworthiness. The Federal Deposit Insurance Corporation (FDIC) protects depositors in US banks against loss due to bank failures. By working with FDIC-insured banks, Trealit provides users with an added layer of security and confidence, ensuring that their funds are protected up to the specified limits.

6. Top Fintech Technology:

Trealit remains at the forefront of the fintech industry by incorporating the latest advancements in technology. The app offers a comprehensive suite of financial services, including mobile banking, digital wallets, investment tools, and payment solutions, all within a single platform. By leveraging top fintech solutions, Trealit ensures that users have access to the most innovative and efficient financial tools available.